34+ deductible home mortgage interest

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Estimate Your Monthly Payment Today.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch.

. Some interest can be claimed as a deduction or as a credit. Trusted VA Home Loan Lender of 300000 Military Homebuyers. If you took out your home loan before.

Web So if your first and second mortgages have balances over 750000 you can deduct interest on only the first 750000 of those. 150000 is paid for the home in 2010 and 10 of it is used for a home office in 2020 for 9 months. For the week of March 17th top offers on Bankrate is 104 lower than.

Ad Refinance Your House Today. If you are single or married and. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web 2020 Tax Year. Web State of Oregon. Web If you took out your mortgage on or before Oct.

Web Topic No. Refinance Your FHA Loan Today With Quicken Loans. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web Generally home interest is deductible on a Form 1040 Schedule A attachment if its interest paid on debt secured by your main or second home. Web See todays mortgage rates. Also if your mortgage balance is.

Web The home mortgage interest deduction reduces tax liabilities most for high-income taxpayers. Ad More Veterans Than Ever are Buying with 0 Down. Web If your home was purchased before Dec.

Well Talk You Through Your Options. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. That assumes youre married.

FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features. 13 1987 your mortgage interest is fully tax deductible without limits. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Since have a mortgage and youre not itemizing your deductions just enter your mortgage interest. Web Mortgages taken by single filers or married couple filing separately after October 13 1987 and before December 16 2017 qualify for a deduction up to. Calculate Your Monthly Payment Now.

Oregon Secretary of State - Home. Youd use option 1 if you were itemizing and claiming. Discover Helpful Information And Resources On Taxes From AARP.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Homeowners who bought houses before.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Over 200000 will make up 34 percent of HMID claims and will take. Web At that point the other 333 of the interest paid on the loan would be a SCH E deductible mortgage interest expense for the remaining life of the loan beginning on. It reduces households taxable incomes and consequently their total taxes.

Interest is an amount you pay for the use of borrowed money. The utilities expense for the year were 4000. Top offers on Bankrate.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81917807 Zillow

113 Iris Ln Morgantown Wv 26501 Mls 10147355 Trulia

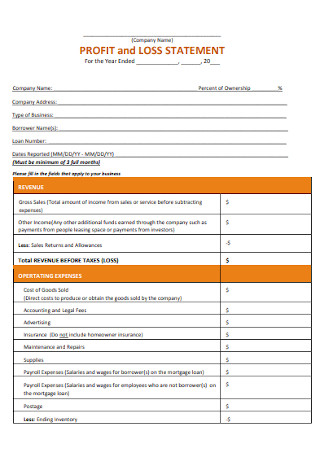

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Terry Alm For All Things Related To Saskatoon Real Estate

11660 St Hwy 125 Bradleyville Mo 65614 27 Photos Mls 60233358 Movoto

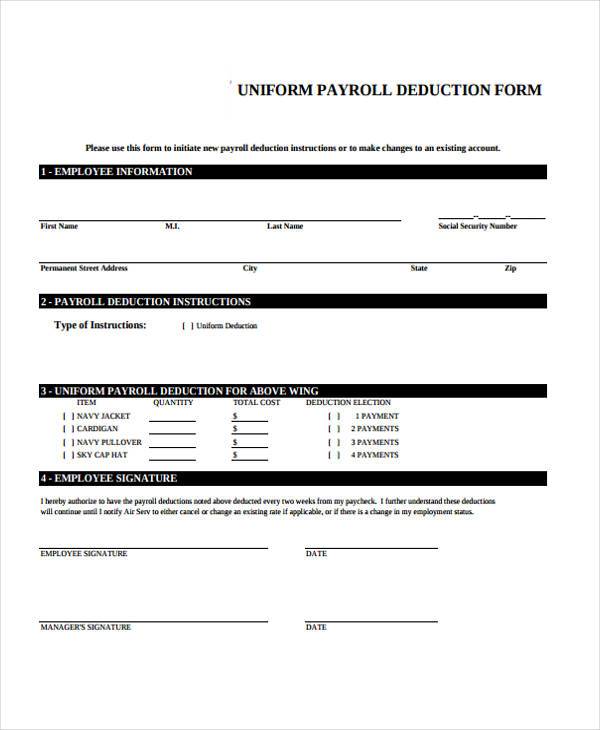

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

Start Learning From Best Platform I Online Programs For Professionals Wagons

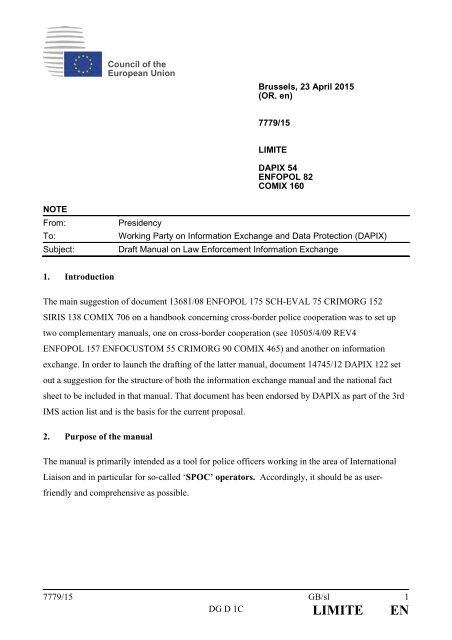

Eu Council Manual Law Enforcement Information Exchange 7779 15

Mortgage Interest Tax Deduction What You Need To Know

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

3504 Beebe Road Newfane Ny 14108 Compass

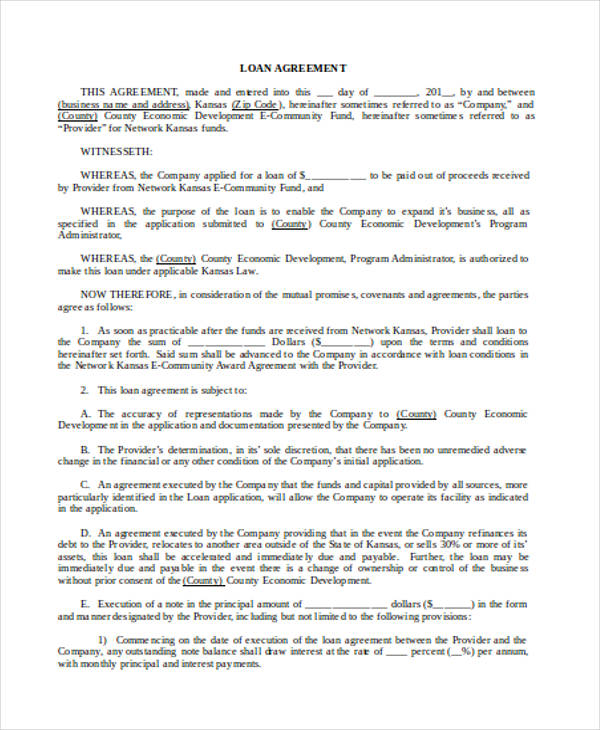

Free 34 Loan Agreement Forms In Pdf Ms Word